Gradually then Suddenly, Bitcoin Fixes the World

An analysis of Money, Inflation and the promise of Bitcoin

Glossary:

I. Abstraction: the problem and solution

II. What is Money?

III. What is Inflation?

IV. Easy Money vs. Hard Money

V. What is Bitcoin?

VI. How does Bitcoin work?

VII. Bitcoin is the shining beacon of hope

Abstraction: the problem and solution

In order for the Mind to create and shape it’s reality, it makes symbols to represent the phenomena it experiences. Whether it be words expressing the palpability of feelings like love and affection, and anger and despair, or numerals signifying the quantity of barley and bricks, the symbols in the mind of man are an abstraction in the form of thought that can not be swapped one for one with the atoms which build up the physical universe. Abstraction is useful to us humans because it helps keep us alive – it allows us to communicate and plan for the future, and consequently requires a thorough understanding of first principles to abstract upon.

Those who understand the adage “health is wealth” realize that in order for money to truly mean anything here on the physical plane, you need to be alive and healthy enough to reap its benefits. Thus, money is an abstraction of physical vitality – money represents the labor and time that went into generating it.

While abstraction is in no doubt useful, it gets us into hot water when we begin to mistake the non-physical, thought-abstractions for the real, physical world. That same water boils when layers of abstraction with no reliable relationship to physical reality compound. This is the current state of our modern, globalized credit-based monetary system; one layer of abstraction built upon another, with little, if any, relationship to the real world shared by the entire population. And it is imploding both as this is written, and as you read this.

It was the non-physical Tyler Durden, in Fight Club, who said “on a long enough timeline, the survival rate for everyone drops to zero.” Before the arrival of Bitcoin, the only truly scarce thing on Earth was human time – now there is a philosophical case that truly, Bitcoin is time.

When looking at the course of recorded history and the numerous civilizations that have risen and fallen, we can extend that quote further to “all physical things go to zero”; what the Buddhists refer to as ‘impermanence’.

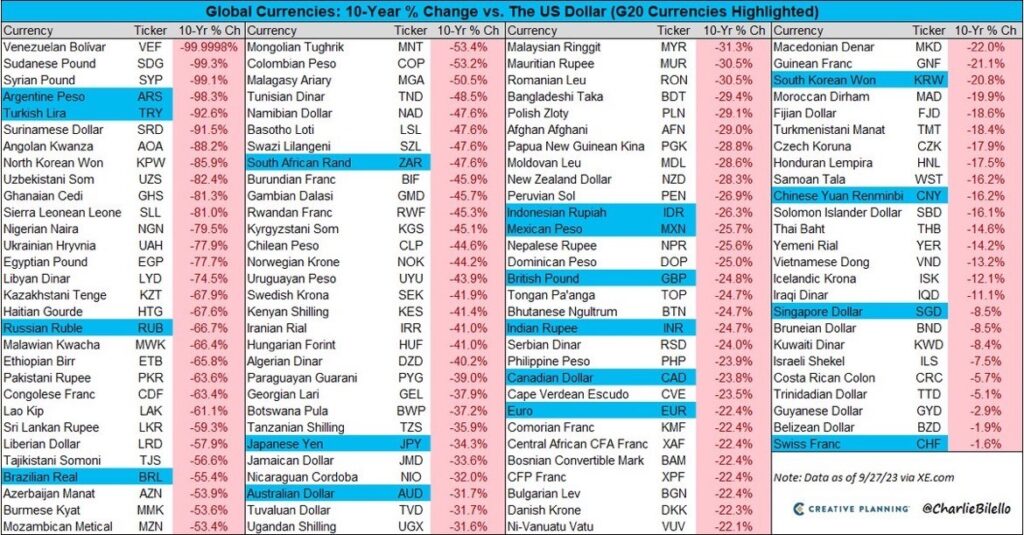

We see this currently playing out in the macro world-picture when we look at countries like Lebanon, Venezuela, Argentina and Turkey whose prosperity and quality of life have plummeted in tandem with the value of their national currencies.

If a national currency is a gauge for the health of a country, then the rest of the world is bleeding out while America patches its gushing wounds.

Are the cases of rampant inflation in these countries the canary in the coal mine – singing their cautionary swan song to the rest of the world about an impending and inescapable fate? If this is so, then what is the solution? To dissolve the remains of what no longer serves our highest potential.

Early adoption driven by financial orphans

If the first question above is true, then likely, the places with higher Bitcoin adoption will be the ones with the higher inflation rates – and that is exactly the case. The country with the highest Bitcoin adoption per citizen year over year has been Nigeria; once skeptical as a collective but receptive to its promise after a corrupt police force began freezing bank accounts and protesters needed a way to transact. Since then, the population has used it as a store of value to escape the Naira’s high triple digit inflation, and as an efficient medium of exchange to bypass predatory legacy remittance rails, allowing Nigerians to seamlessly transact with family members abroad.

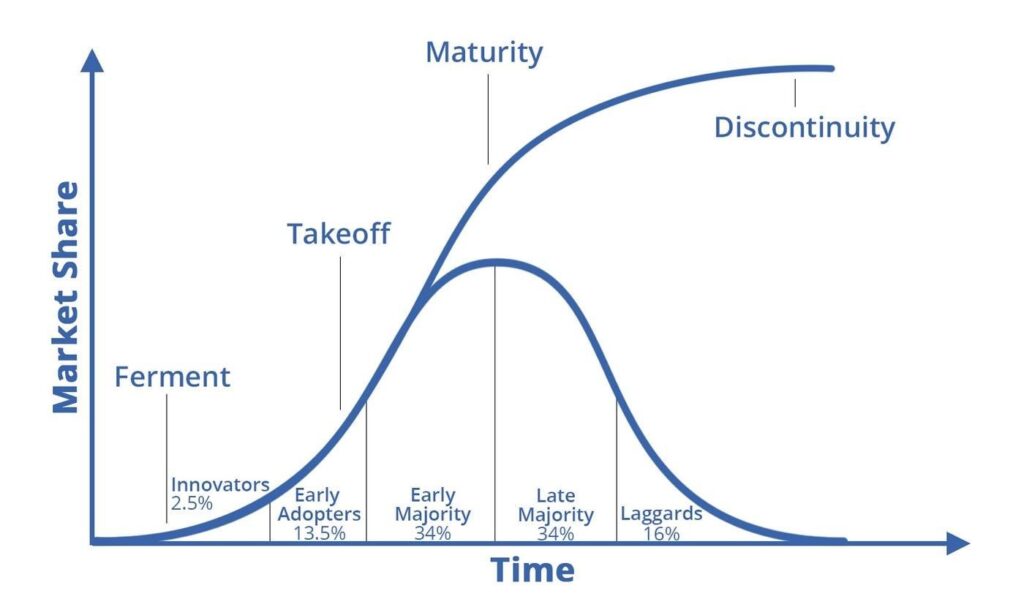

When a new, disruptive technology hits the market, it can be seen to follow an ‘S-curve’ where there is a period of relatively slow growth, before a far more sharp, exponential explosion as the new technology overtakes the incumbent as the status quo.

When analyzing Bitcoin’s adoption on an s-curve, it looks like we are still in the early innings. (Source: Matthew Yang)

While it is practically impossible to distinguish exponential growth from linear growth in its early stages, history has shown time and time again that adoption of exponentially beneficial tech follows the ‘s-curve’. Depending on what metrics you look at, global Bitcoin adoption is somewhere between 0.01%-3%, in comparison to legacy forms of money (e.g. precious metals, equities, debt, art, etc). For a detailed look at disruptive technologies and the ‘s-curve’ – see RethinkX’s Rethinking Humanity.

What is exciting about Bitcoin is that it disrupts the very technology of money itself. Money can be seen as the substrate of civilization, because without it, no advanced organization or specialization could occur. Bitcoin offers the choice to move to a parallel system with money that is an abstraction of truth, yet tied to physical reality, as opposed to an abstraction of deceit unconstrained by any of Nature’s fundamental laws.

What is Money?

Before we can talk any further about the nuances of the current monetary system, how we arrived here, and the mechanics of Bitcoin, it is fundamental to understand first principles. Therefore, we must ask the seemingly simple question… What is money?

In its essence – money is a technology created to harness economic energy, thus increasing the efficiency of trade and offering a vehicle to store value into the future. While technically speaking, anything can serve the function of money, in reality, there are a few key features which determine the sound-ness of the chosen monetary medium. As we will see, the three primary functions of money are to serve as a medium of exchange, a unit of account and a store of value.

Using a small economy to demonstrate the functions of money

In a hypothetical, small, primitive, island society; if Jane grows apples and Jill grows oranges, and both want the other, they can trade directly – this is known as a ‘coincidence of wants’. Here Jane and Jill are using fruit as money, however this would be more colloquially known as ‘barter’. As Jane is willing to trade two of her apples for every one of Jill’s oranges, we can say that the purchasing power of Jill’s orange is worth two apples, or, there is a two-to-one, apples to oranges exchange rate.

In a case with no such coincidence, where Jane wants oranges but Jill does not want apples, they need to find something they both value in order to let them transact, this is what is known as a ‘medium of exchange’. In comes Joe with his bananas, which Jill wants, and luckily Joe is looking to trade for Jane’s apples. Jane is then able to trade her apples for Joe’s bananas, and finally use the bananas to purchase Jill’s oranges. It is only with the arrival of Joe and his bananas that the two are able to find a medium of exchange which solves their dilemma.

As the trio’s village grows in numbers, they start to find they are not able to save more than a month into the future, as their money (i.e. various types of fruit) begins to rot after a few weeks. One day, a village member named Jeff figures out he can use sand, soda and limestone, in combination with a furnace to produce glass beads. These glass beads are durable, as they do not degrade as time progresses, and divisible as Jeff blows the beads into small units. Due to these new emergent qualities, the village people naturally start using the glass beads to transact, as this new medium of exchange allows for a reliable store of value and a unit of account.

Sound money calls forth humanity’s best

With money that is more sound, the village now has the ability to save into the future and perform precise payments for economic goods and services. As a result, the villagers begin to sacrifice their present moment ability to produce, in order to develop techniques to produce more efficiently in the future. Where previously the fruit money only held its purchasing power for a matter of days before it went bad, and was hard to transact with due to the various exchange rates; the durability and divisibility of their new money allows for its users to specialize in new forms of economic production. Jane, Jill, Joe and the others are now able to spend the time they previously spent bartering with each other, crafting fishing rods and irrigation techniques that improve the output, quality and variety of their food supply. This is the essence of investment, which fundamentally carries the risk of failure if time spent on the project does not produce enough output to offset the deferred time which could have been spent producing something else (referred to as the opportunity cost).

Investments are fueled by creativity and innovation and have arguably been the largest catalyst for human development and improvement of living standards across societies and civilizations throughout time. Under a sound form of money, investments and technology flourish as individuals have the means to conserve their hard earned economic energy (i.e. money) through saving, before allocating it to productive endeavors.

Under the Gold Standard of the nineteenth century, the roughly thirty year period between 1870 and 1903 produced the inventions which constitute the majority of modern life today; the telephone, incandescent light bulb, camera, automobile and airplane1 are all products of a monetary system which incentivized saving and called forth ingenuity.

Another way to say this is: sound money motivates individuals to lower their time preference. A low time preference means that one places more value on future consumption than current, and seeks to improve their circumstances over time. People with a high time preference prefer immediate consumption and are less inclined to save.

Consider the famous ‘Marshmallow experiment’ conducted at Stanford in the 1960’s; children were given a single piece of candy and told they would receive an additional piece after fifteen minutes if they held off on eating the first. As one can imagine, some of the 4 and 5 year olds could not resist, while others were patient and graciously received a second piece. What is fascinating is that the subjects were followed for 40 years, and those who delayed gratification measured higher in virtually every category possible.2 From test scores to physical and mental health, the results underscore a clear correlation between low-time preference thinking and better life outcomes.

Scarcity makes or breaks money

To return to our example, the remote society is thriving on account of increased crop yields from agricultural investments, novel hunting technology bringing in new food sources, and construction innovations improving housing – all products of low time preference oriented individuals collectively contributing to improving life under a sound form of money. As Jeff is the only person who possesses the skills to produce the glass beads, and the raw materials are hard to find, the society’s newly chosen money is scarce. Along with durability and divisibility, scarcity is one of the most crucial factors in producing a sound form of money. As the new supply of beads Jeff produces is always small compared to the existing amount circulating in their economy, the glass beads have a high stock-to-flow ratio. Monetary media that are scarce always possess a higher stock-to-flow ratio than ones that are more abundant and easier to produce.

One day a boat arrives on the isolated society’s shores, and the passengers aboard find it curious that these primitive people are using glass beads to run their entire local economy; for what could buy ten houses in this small society cost the equivalent of a week’s supplies back in their homeland. In quick time, the sailors began using all of their cheap glass beads to buy most of the town’s food supply, and even made a trip home to stock up on the easy money. What was once a money with a high stock to flow ratio quickly plummeted as the supply increased orders of magnitude virtually overnight.

When the sailors returned with more beads in hand, they leeched the remainder of the economy’s lifeblood through trading their de minimis cost glass beads for the entire fruit of the society’s labor. While now the villagers were rich in glass bead terms (or nominal terms) they were not in real terms, as the little economic energy (i.e. food and resources) that remained were either consumed by the producer or only sold for multiples of their historical price. Eventually, many people began having to sell themselves, and their children into slavery.

While the hypothetical example above is both simplified and dark, it closely mirrors the events of the fifteenth century European colonization of Africa and sixteenth through nineteenth century ‘Trans-Atlantic Slave Trade’ and illustrates the immense power that comes as a result of controlling the money supply. History has repeatedly shown that this power allows for the confiscation of wealth from the populace and the subsequent instillment of a ruling elite over a slave class. For more information on this episode of history and the dynamics of this highly corrupt practice, see Robert Breedlove’s ‘Masters and Slaves of Money’.

What is Inflation?

Have you ever wondered what inflation really is, and why over time, prices tend to increase, or phrased differently, why $1 appears to lose its purchasing power as time goes on? Consult your average ‘Principles of Economics’ university textbook or local government agency and you won’t get a simple or clear answer – however you will find something along the lines of “more jobs and higher wages increase household incomes and lead to a rise in consumer spending…increasing aggregate demand and… prices of goods and services”.3 Ask a more high-brow economist and they will likely refer to ‘animal spirits’, a term coined by the late economist John Maynard Keynes, attempting to attribute these cycles of economic expansion and recession to human psychology; when prices go up people are confident and when prices go down there is a lack of confidence.

While these theories contain partial truths (like all convincing lies), they fail to address the underlying dynamics of the situation; why then, do unemployment and inflation both rise during a recession and why do people routinely lose confidence in the economic system? The answer is simple, however you will not find it in the majority of economic literature out there.

Like most definitions, the true meaning is baked into the word. ‘Inflation’, or the loss in purchasing power over time, occurs as a result of the entire money supply being inflated, or in other words, increased.

Inflation throughout history

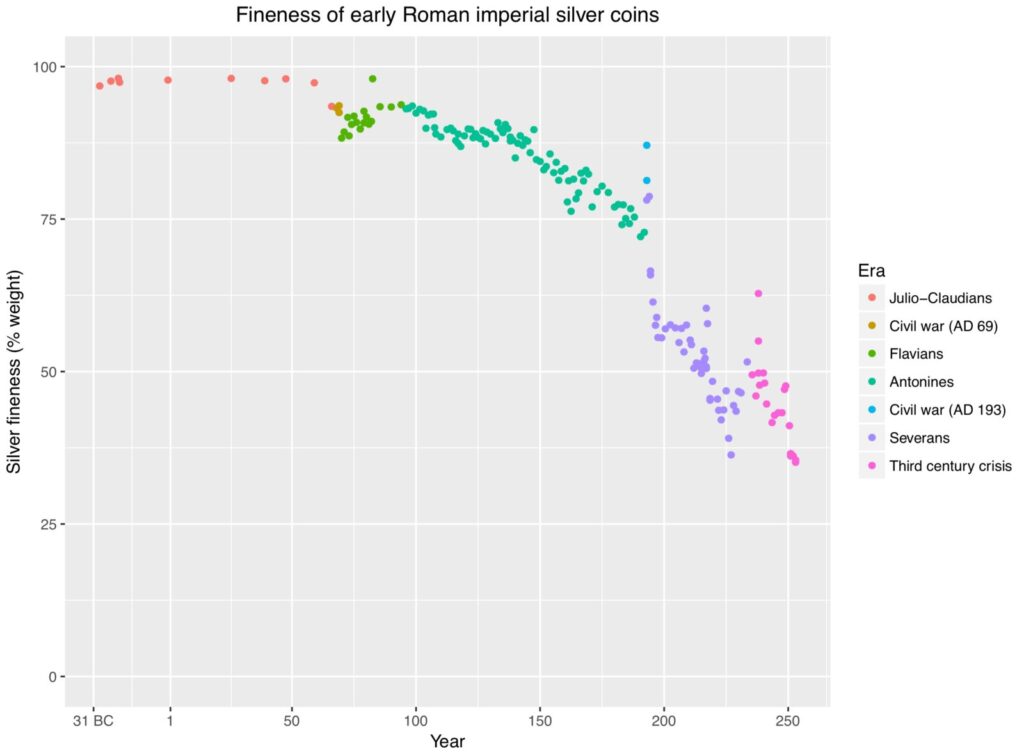

Throughout recorded history this dynamic has continued to rear its head. The previously mentioned ‘slave beads’ are one prominent recorded case of rampant inflation, however an earlier example would be the practice of ‘coin clipping’, carried out by the majority of Roman leaders, and largely contributing to the fall of their empire.4 In this time period silver was used as the primary type of money (in the form of coinage), and was constrained by the amount that could be mined (profitably) per year. In order to finance the growth of the empire, primarily through military endeavors, rulers could not resist the temptation to devalue their currency by decreasing the amount of silver in their coins, effectively hoarding more silver for themselves and counterfeiting what was appropriated. When soldiers and citizens realized this, or simply felt the value of their wealth erode, they demanded increased wages to compensate for the loss in their purchasing power.

The amount of silver per coin steadily decreased throughout the Roman Empire. (Source: wiki)

During the early Roman empire, under a sound money (i.e. when coins were not clipped), the government and their military were limited by how much tax could be collected from their citizens to fund expansion. Leaders who used taxation to fund power-hungry, overreaching wars or renovations to their palace were likely to be far more unfavored by the populace than rulers who taxed to increase general living standards. Coin clipping solved this “inconvenience”, and meant governments could now finance their power expansion without general consent, as they could essentially create money out of thin air. In actuality, the population’s wealth was still being confiscated, but through a much more subtle tactic, monetary debasement. Is this starting to sound familiar?

Another iteration of this dynamic occurred in the early twentieth century, and can help illustrate what caused the Great Depression. This time period saw the widespread emergence of maturity mismatching, more commonly known as ‘fractional-reserve banking’. Simply put, this practice means that a bank’s reserves (i.e. what they hold in their vaults) equate to only a fraction of all their clients’ deposits (i.e. holdings). While the US was technically still on the gold standard, meaning that all paper dollars were redeemable at the bank for gold; from 1921 through 1929 the paper money supply grew over 68% while the gold reserves backing the currency only increased 15%.5 This led to the illusion of wealth creation, creating a bubble which manifested as an increase in stock and housing prices. As most of this increased value did not actually exist, the house of cards came crumbling down when people began to demand gold for their cash and were not able to recoup the purchasing power they had entrusted in their US dollars.

Fiat (funny) money – the new debt based system

It was not until 1971 that President Nixon declared to global trading partners that US dollars were no longer redeemable into gold, ushering in a new era of fiat policy where governments were completely unconstrained by anchoring their currency to reality, and could increase the money supply to finance their civic and military agendas without having to expressly get their populations consent through taxation.

The website ‘WTF Happened in 1971’ hosts a plethora of graphical data capturing the consequences of this derivation from backing the world reserve currency in physical reality. Perhaps what is most striking is the exponential rise in everything from stocks and housing prices to federal debt levels to frequency of currency collapses, and a decrease in personal savings, income growth and birth rates.

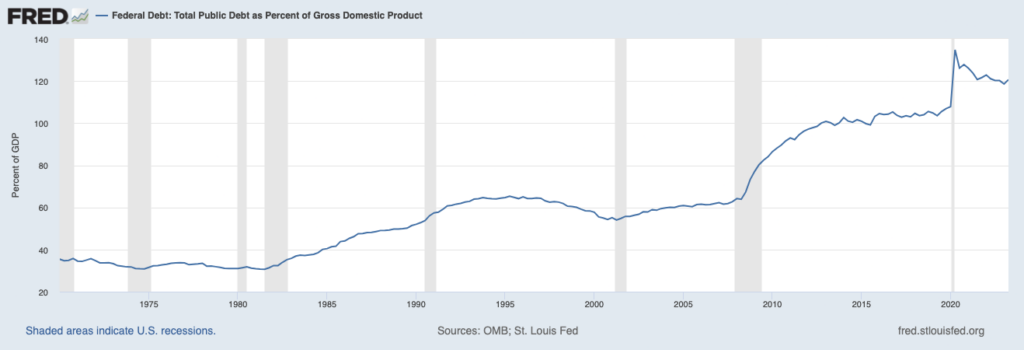

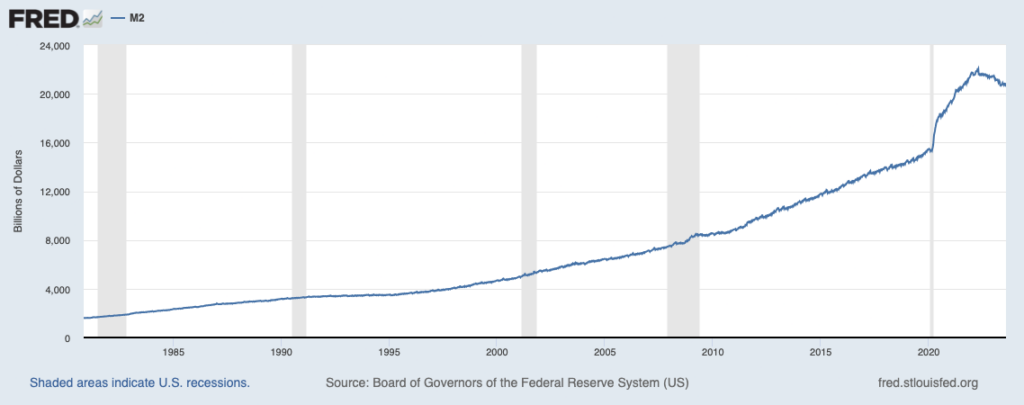

Clearly unsustainable – America does not generate enough revenue to pay its expenses. (Source: FRED)

As the US dollar is not backed by any scarce resource, this means paper bills and digital zeros in bank accounts are in essence, coupons (or ‘IOUs’) from the government. Functionally, this means that the money supply is not only increased when the Federal Reserve (i.e. the central bank) prints more money, or injects liquidity onto federal balance sheets (known as quantitative easing), but also when a bank simply issues a loan. Fractional reserve banking means that when an individual takes out a mortgage to buy a house, the bank creates the money out of thin air to buy it; writing the purchase of the home loan as an asset, while funding the purchase through the issuance of liabilities such as bonds or CDs.

Fiat money is a credit/debt based system. In other words, banks issue credit, which is non-existent capital, to allow people to buy real things with debt, which is the flip-side of the same non-existent credited capital. This exchange of non-existent (i.e. unbacked) capital (i.e. money) for real, valuable assets (e.g. houses, education, food, etc) means that over time one needs increasing amounts of the unbacked money to buy the very same things, not because the things got more valuable, but because the money got less valuable. When the stock-to-flow ratio of the monetary medium decreases, the value of the money decreases, and people who are not involved in the production of the money lose their purchasing power in direct or greater proportion to the increases in the money supply (i.e. the Cantillon effect).

While both the bubbles which popped in 1929 and 80 years later during the Global Financial Crisis may on their face appear to be caused by different factors, the root of the problem is the same – unbacked credit expansion. With the Great Depression primarily affecting the stock market (although it too affected home prices), as this was the asset class which most people invested their dollars into, the Global Financial Crisis of 2008 culminated in a bubble around subprime mortgages (i.e. home prices) before becoming a systemic failure which underscored the fragility of an economic system no longer tethered to physical reality. Essentially what this means is that many banks were driving their growth and expanding their revenue streams by issuing mortgages that were artificially low priced, in an economic environment where real prices were rising due to inflation- yet another iteration of fractional-reserve, maturity mismatching with devastating consequences to society.

In looking back at any recession in the past century, the dynamic is the same: as the influx of US dollars through credit expansion gives people the illusory sense of wealth, many feel incentivized to use assets (i.e. homes, stocks) as a form of savings to mitigate the effects of inflation, due to their respective prices continuing to rise while interest rates continue to fall. What many often fail to realize is that the ever growing prices are not reflecting a true increase in their value, but instead reflecting the extent to which the money supply has been increased. The entire notion of the Federal Reserve fighting inflation through monetary policy is completely backwards; the central banks unconstrained, meddling monetary policy and their safeguard against the obvious ill-effects of fractional reserve banking is the very thing causing inflation in the first place.

M2 money supply has increased over 10x since departure from Gold Standard. (Source: FRED)

Since the fallout of the GFC, and in response to more recent crises such as the COVID pandemic, the ‘M2’ money supply (which includes deposits, IRAs and MMFs; the vehicles the majority of the population uses to save) has effectively tripled.6 Put simply, this means that if you have ten $1 dollar bills in your wallet, six of them were created after 2008. In a fiat system, you need to make your money twice, once through your labor and another to beat inflation.

Easy Money vs. Hard Money

As numerous examples over the past few millennia have demonstrated, there is a marked difference between when a monetary system is based on a sound medium, leading to prosperity and relative peace, and when one revolves around an unsound form of money, resulting in inefficiencies, conflict and extreme wealth divide to the point of enslavement. More specifically, when a monetary medium has a high stock to flow ratio, the money is sound, largely due to its scarcity, whereas a money with a low stock to flow ratio quickly inflates and devalues those who are not involved in production of said money. From this we see that money can be hard to produce, making it scarce and valuable on account of this quality, or easy to produce, which leads to the inevitable over production to enrich the producers at the expense of the rest of the market (i.e. holders).

A race to the bottom

As money loses value in an inflationary system, producers are faced with a choice between investing in their products to make them better, with the hopes of increasing sales, or scaling back their costs and decreasing quality in order to compensate for lost purchasing power. A ‘race to the bottom’ occurs when competitors in a market settle on the latter; once this dynamic begins, it is hard to stay competitive without taking shortcuts. This could help explain why we see ingredients in many food products in the US that are outlawed in other parts of the world,7 dumping of hazardous materials in natural (and human populated) habitats,8 and increasing amounts of industrial accidents on account of improper maintenance and staffing.9 While these issues could be addressed with further regulation, or truly solved with the trillions of dollars allocated to military budgets, the incentive structures of the fiat system mean that anything that hurts the bottom lines of major corporations is hard-pressed to see the light of day, even if it improves or saves human lives.

A race to the bottom hurts the entire population for the benefit of a few. (Source: IPS)

Easy money erodes the health of society

Those who benefit from the fiat system, and have either conscious or unconscious motivations to keep it alive are the ones who are closely tied to the production of money and to industries which are reliant on government expenditure. While it is a no-brainer to realize that central and national banks receive unprecedented privilege by the ability to create money through credit expansion, the second order effects of this incentive scheme have begun to rip the very fabric of society.

The Military Industrial Complex, the multitude of multinational conglomerates whose bottom line comes from selling weapons of death and destruction creates ‘forever wars’, fought less over moral, ethical and territorial disputes but truly as a market to continuously outfit soldiers and armies with the latest means to incinerate their opponent. If profits are made from war, then we can reasonably say there is a vested interest by profit takers to keep them raging. This fact was acutely foreseen and fatally forewarned over 60 years ago by President Eisenhower during his 1961 Farewell Address:

“In the councils of government, we must guard against the acquisition of unwarranted influence, whether sought or unsought, by the Military-Industrial Complex. The potential for the disastrous rise of misplaced power exists and will persist.”

The over 230 million human lives that perished over the course of the 20th Century, at the hands of governments and their armies, is a testament to this fact. To quote Ike, once more:

“Every gun that is made, every warship launched, every rocket fired signifies, in the final sense, a theft from those who hunger and are not fed, those who are cold and are not clothed. This world in arms is not spending money alone.”

Eisenhower here underscores the immense opportunity costs which are foregone when an unsound money incentives low time preference decisions, such as those to fight and kill fellow humans to enrich a few, instead of helping those who are vulnerable to build a stronger and more sustainable future.

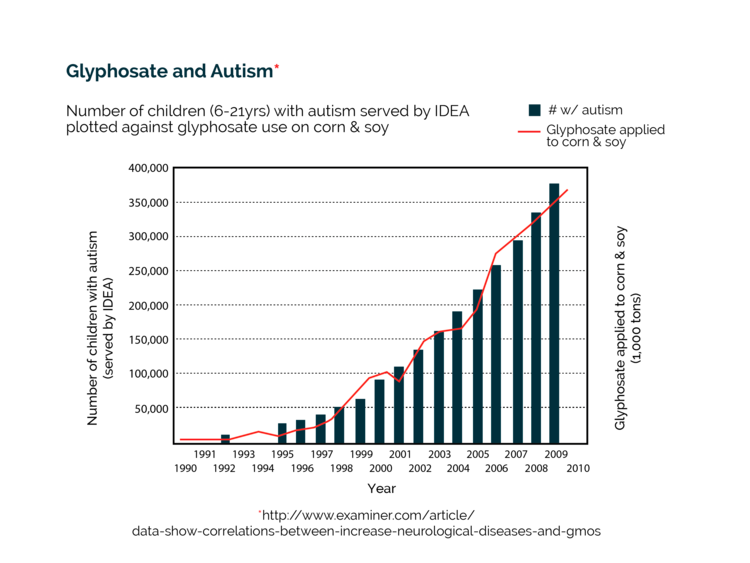

However, the effects of fiat are not only felt when it comes to armed conflicts, but also something as seemingly innocuous as food choices. Much of the food supply in the United States has toxic chemicals with names that are next to impossible to pronounce, while the farming industry’s use of Glyphosate (the poisonous herbicide ingredient in the weedkiller, ‘RoundUp’) is now estimated to have leached into 80% of the water supply.10 With a plethora of studies now demonstrating clear correlations between unbalanced microbiota species and virtually all varieties of diseases11, it is not a stretch to point towards these cellular-level napalm chemicals as a major factor in the rapid rise of neurodegenerative and autoimmune diseases since RoundUp was first brought to market in 1974.

“Autism spectrum disorder has risen in prevalence from 1 in 5000 children in 1975 to 1 in 36 children in 2016. And the rate has been doubling every 3-4 years in the last decade in the US. We are on target to experience 1 in 3 children with Autism by 2035.” (Source: USADA/Dr. Zach Bush)

One would hope that even if they got sick from a poisoned food supply, that at least doctors would be able to set their ailments right; unfortunately however, this is not the case in the fiat system. Why? The Pharmaceutical Complex has largely fostered the medical industry into a legion of professionals only concerned with diagnosing and treating, with no thought towards preventing or healing. If these corporation’s bottomline comes from the amount of medication or vaccinations sold, then healthy people are not good for pharmaceutical and medical businesses. Whether it be doctors who are given profit schemes to prescribe specific medications, or regulatory capture where former regulators become pharma execs, the incentives of the system take on a life of their own much similar to that of a cancer cell, growing unceasingly with no regard for the health of the whole – it will either take death, awakening or both before something new can fully regenerate.

Finally, it is the fiat incentive structure’s capture of the media which allows the previously mentioned Complexes to perpetuate; often so convincingly, that much of the population will have a charged emotional reaction when presented with counter evidence.

Whoever controls the media, controls the mind.

– Jim Morrison

Anyone who has watched cable TV in the past few decades knows that over half the commercials on air in the US are for pharmaceuticals, and that Pfizer is one of CNN’s (among numerous other networks) largest advertisers. This is an undeniable amount of leverage to have over any news agency; and given these news outlets are reliant on advertising revenue to stay profitable, it means that their incentives must be aligned, albeit even if untruthfully.

If the current, zero-sum incentive structures of our economic system, where a majority of economic growth is driven through stealing from the population, were upgraded to a monetary asset which was truly hard to produce, then it is extremely unlikely that crony politicians, needless wars, toxic food and corrupt executives would stay in business.

Fix the money, fix the world.

– Bitcoin proverb

What is Bitcoin?

Launched in 2009, Bitcoin is the first successful implementation of a digital form of money which doesn’t require trust in any institution.

To steal from the words of the ‘Bitcoin Whitepaper’, the document which accompanied the technology’s ingenious invention, and written by its pseudonymous founder, Satoshi Nakamoto – Bitcoin was created to be a “purely peer-to-peer version of electronic cash”. In this sense, ‘cash’ means a bearer instrument which can be used as final settlement, while ‘peer to peer’ simply means that everyone who uses the network has equal rights. It’s all users, no admins; so there is no need to put trust in or get approval from any intermediary to transact.

A ledger and a protocol

While it may seem natural to think of the Bitcoin protocol (or bitcoin transactions) as the movement of digital gold or orange coins around in cyberspace – a more accurate description is that of a digital ledger. Ledgers are a record of all transactions between accounts and have been instrumental to the operations of banks and financial services through time immemorial, as by their very essence, they denote who owns what. What novelty Bitcoin has added to the notion of the ledger, is that due to the perfectly balanced nature of its key stakeholder groups, the ledger is immutable, meaning that no one person or group can alter the record of transactions for their personal gain.

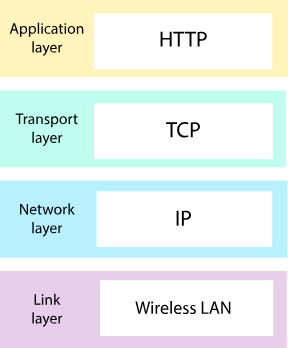

More specifically, Bitcoin is a software protocol which is agnostic of any one device or operating system – meaning that anyone with a computer (or internet connected device) in the world can access it. Much like how there are protocols for the Internet (i.e. TCP/IP, HTTP, etc.), and email (i.e. SMTP, POP, IMAP) which facilitate the core functions which we refer to as ‘the web’, Bitcoin is a protocol which facilitates the core functions of money. As these protocols are ‘open’, anyone can view, use and update the code, and because it is not controlled by any one entity, the network of users are free to decide on the protocols they use. Demand-side economies of scale (i.e. ‘the network effect’) means that the protocols people agree on and use will inevitably end up being the winners. This is not to say one cannot create new protocols or alter existing ones, however if the majority of people stay using the original protocol, one’s accessibility or reach is then limited by changing. It’s highly unlikely someone is going to stop using TCP/IP and HTTP, as even if they had other functioning protocols to serve as the internet, they would not get access to the myriad of content and websites posted and hosted by the billions of TCP/IP and HTTP users since their inceptions. This is also one reason why it is highly unlikely any other “alt-coin” will overtake Bitcoin in the role of money, as even if an identical or updated Bitcoin code was created (which have been), the original Bitcoin source code has the ‘first movers advantage’. Trading one’s value from the “tried and true” Bitcoin to a new ‘hard-fork’ would be highly risky.

An aside: “The Trilemma”

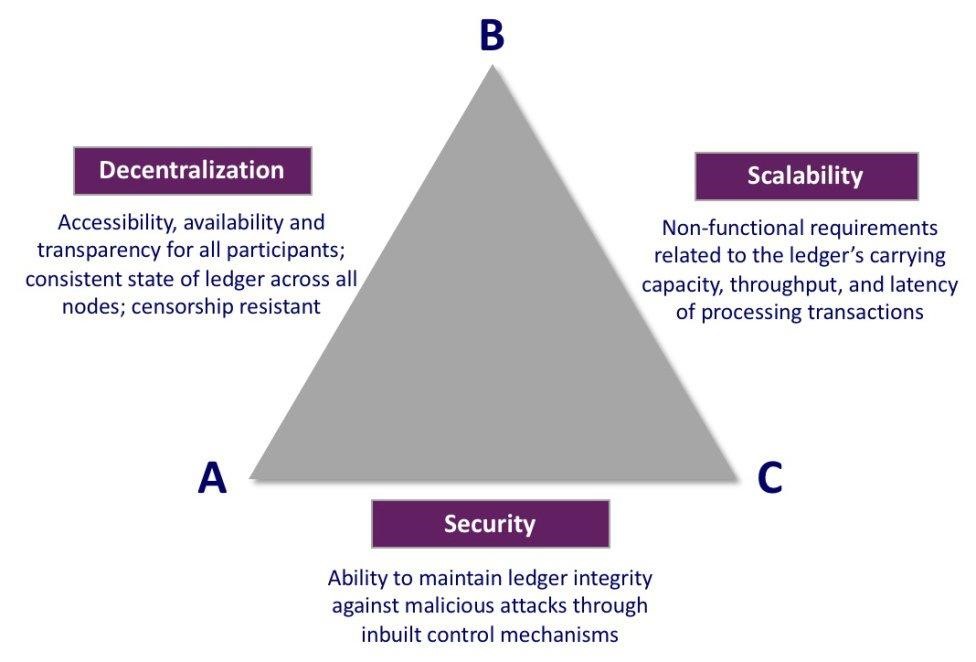

The entire reason that alternative protocols were invented is because certain groups of people thought that Bitcoin’s design was not enough. Vitalik Buterin, the founder of Ethereum, famously coined the notion of the “Trilemma” – stating that developers must make a sacrifice between security, decentralization and scalability when working with these novel protocols.

Decentralization and security are integral, while scalability is a non-functional requirement. (Source: ReverseAcid)

It’s clear given Ethereum’s public leadership and product roadmaps that it was decentralization to be fatefully picked for sacrifice on the altar of their fiat-inspired network. While Vitalik may be partially right about only two of the three criteria being able to be satisfied, what he missed was that this was only the case on the base layer, and that additional layers can be built to increase usability and efficiency. When it comes to the transfer of digital value and information, security and decentralization are the essential criteria which the whole system must be founded on, while scalability can be solved for on following layers.

As a case in point, the DAO hack of 2016 which occurred on the Ethereum network, where an individual was able to reroute $60 million dollars worth of the tokens to his own wallet demonstrated that the Ethereum network’s ledger is not truly secure. Additionally, as the fix involved the politicking Ethereum team members needing to advocate for a hard fork which created a new version of Ethereum, it is clear that their ledger is neither truly immutable nor truly decentralized.

With this in mind, one can begin to see how Vitalik’s Trilemma is a false premise, and that security and decentralization are what constitute a distributed network’s value. Scalability is of secondary importance, and while it needs to be addressed, it’s crucial to discern when it is being used as a ‘Trojan horse’ for a centralized power grab. Fractional reserve banking was the scalability solution under the Gold Standard, which is now the primary problem with fiat money and has predicated every economic crisis we’ve seen since the Great Depression.

(A rule of thumb: if the functions of a distributed network, like smart contracts [a.k.a. rule of law], can be maintained accurately on a centralized database(s), there is no need for it to be stored on a decentralized network in the first place, it is only inefficient and wasted productivity.) This simple fact calls into question the viability of virtually all alt-coin (a.k.a. shitcoin) projects, which attempt to solve non-existent problems.

Open protocols grow in layers

While admittedly this is not intuitive, what Vitalik failed to realize (or purposely omitted for financial gain) is that open protocols always grow in layers, as historically has been the case. Consider the fact that there were over 20 years of developmental layers which led to the invention of the internet as we know it, beginning with TCP/IP in the late 1960’s and culminating with HTTP in the early 1990’s. This notion of a layered approach to development is the only way that open source protocols can grow organically over time, as the network of users must come to an agreement on the fundamental aspects of the protocol which will serve as its foundation, before developing additional functionality.

With the Bitcoin community agreeing on security and decentralization as the non-negotiables, scalability is being solved with the advent of the Lighting Network, a layer 2 solution (i.e. L2), allowing for instant transaction settlement, while periodically engaging in final settlement on the base layer. This is very similar to the way the current financial system works, with credit cards and consumer payment applications (i.e. Venmo, PayPal, CashApp) acting as L2 and L3 solutions that allow instant settlement of smaller payments, while big transactions reach final settlement between the base layer (L1) of banks and financial institutions every 30 to 90 days. Bitcoin swaps the legacy system’s months until final settlement for a comparably immediate 10 minute interval.

Different layers support different functions. (Source: Khan Academy)

How does Bitcoin work?

Every part of the whole conforms to the nature of the whole and serves the purpose of the whole. This cannot be accomplished if some other nature – either external or internal – governs the parts.

– Marcus Aurelius

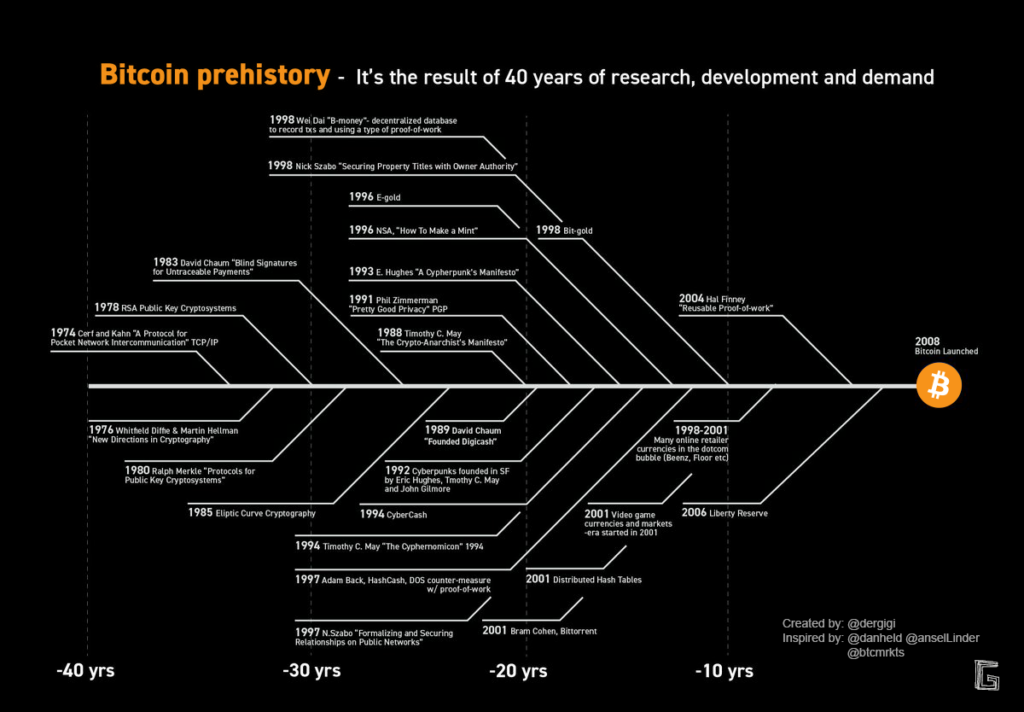

While Bitcoin’s arrival on the world stage may have seemed abrupt and without warning, in truth its creation was catalyzed by decades of progress in the computer science and cryptography arenas. Nonetheless, the manner in which Bitcoin’s creator baked all the right ingredients together was nothing short of meticulous, elegant and profoundly thoughtful. If Satoshi was a pizza chef, and Bitcoin was their pie, we can say that the main ingredients used were an organically balanced network of key stakeholders, an open source protocol with a predetermined monetary policy, the Proof of Work (PoW) consensus mechanism, and public-key cryptography.

Bitcoin’s invention was no technological fluke.

Organically Balanced Stakeholders

Bitcoin’s stakeholders include its users, nodes, miners, and developers – all of which are crucial groups with respect to its core operations, however individual actors within each stakeholder group are completely dispensable. No one figure or group of authorities are necessary for Bitcoin to operate. There is truly something special and highly unlikely to be replicated with regards to the fact that Bitcoin was launched without a publicly known leader or group, and its network of users grew organically over time without any pre-required investment or advertising. In the Bitcoin community this has been referred to as the immaculate conception.

The Immaculate Conception by Giovanni Battista Tiepolo (1767 – 1769) – Bitcoin’s birth was biblical.

Bitcoin’s network of nodes are the component of the protocol which maintain its decentralization. A node is simply a computer program run on an average laptop which carries and updates an identical copy of the ledger (i.e. the entire record of transactions) roughly every ten minutes. As each node has the ledger, no one node is critical to the operation and success of Bitcoin. When someone wants to send a transaction, it is the nodes that validate that there are the correct amount of units between accounts to transfer.

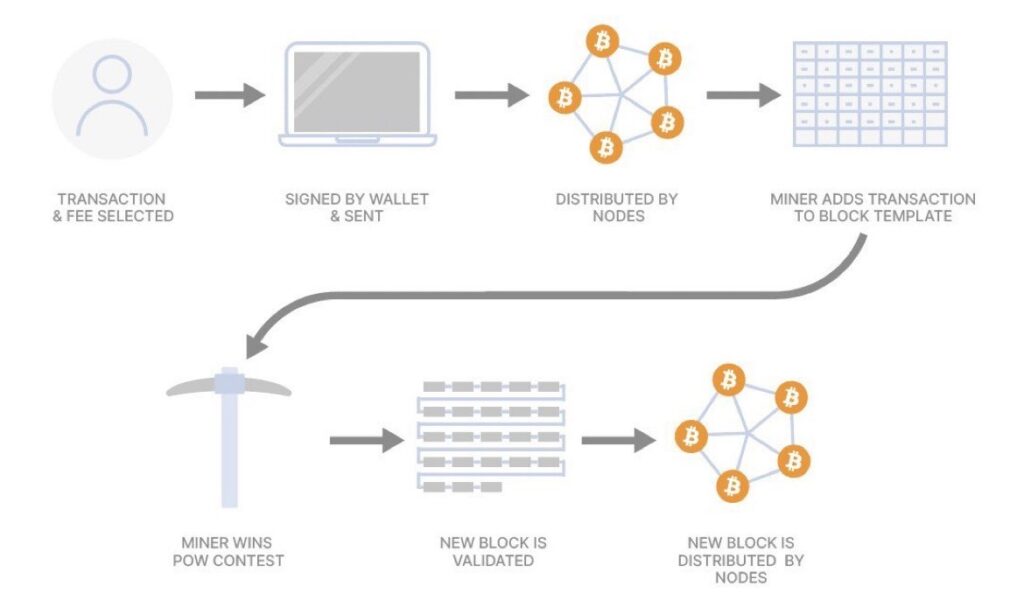

There are certain nodes who validate new transactions by solving complex, cryptographic equations known as ‘hashing functions’ (specifically the SHA-256 hashing function) which bring new bitcoins into circulation. As it takes large amounts of energy in the form of processing power to add new coins to the supply, much like the production of precious metals, this process is known as ‘mining’. (A rule of thumb: all miners are nodes, but not all nodes are miners.)

Whereas in the early formative years, bitcoins could be mined off a regular desktop computer, the processing power that is now required has grown so much that specialized hardware devices known as ASICs are now needed to mine competitively. Miners who solve the hashing function first are then the ones who add the next block of transactions (which are then subsequently validated and accepted by all nodes), and in turn receive a block reward. The block reward consists of the block subsidy, a predetermined amount of new bitcoins that are brought into circulation, as well as transaction fees paid by transaction senders to incentivize miners to include their transactions in a block first.

Simple Bitcoin Mechanics Flowchart (Source: Unchained)

Open source protocol with predetermined monetary policy

As we’ve noted, Bitcoin’s protocol is open source, making its rules public to everyone, and participation in the network a choice to opt into. The rules that stick are the ones that are adopted and chosen to run on the majority of the network’s nodes.

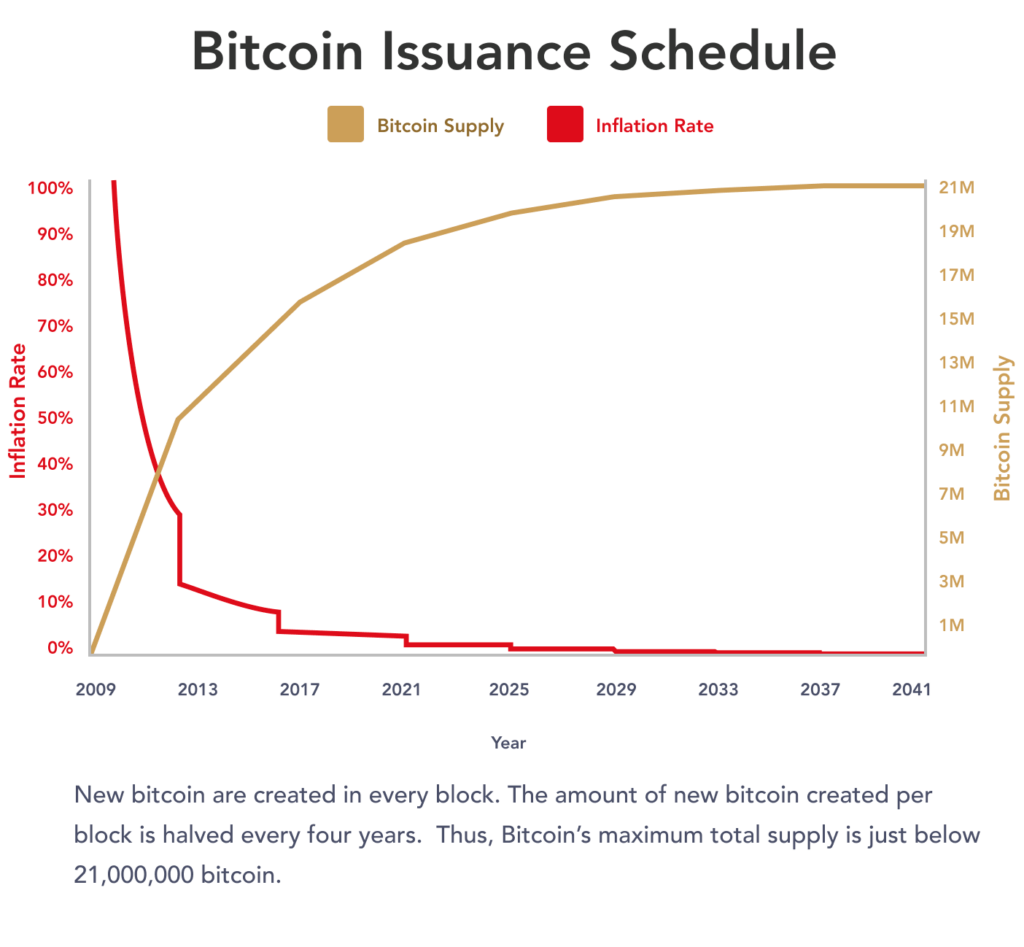

Roughly every four years, the block subsidy is decreased by 50%, known as a halving. When Bitcoin was launched in 2009, 50 new bitcoins were included per block, whereas after the upcoming halving near April of 2024, only 3.125 new bitcoins will be brought into circulation per block. Around the year 2140, the final one hundred millionths (or satoshis) of a bitcoin will be mined, and the asset’s inflation rate will go to zero. This makes Bitcoin the first ever monetary asset with a truly scarce supply, capped at 21 million bitcoins.

Predetermined issuance schedule and inflation rate. (Source: River)

While in theory, a majority of the network of nodes could opt into an updated protocol which increases the supply past the 21 million set limit, or increases the block reward, in practice this is impossible as the incentives of the network are so fundamentally oriented towards truth and verification that no node or individual (nevertheless the collective) would ever do this as it would devalue their own holdings.

An example which will help illustrate the network’s resilience more clearly is the Blocksize Wars which occurred in 2017. For context, each block of transactions has a limit of 1MB of data, which means that only a certain amount of transactions can be recorded on the Bitcoin ledger per day. There were a small but meaningful number of people who felt that this was a flaw in Bitcoin’s design and that the 1MB per block should be increased to allow for a higher transaction volume. The inherent trade off, which was clear to the greater Bitcoin community, was that by increasing the block size past 1MB, regular consumer laptops would no longer be able to run nodes, and the network would become centralized around institutional nodes who had the capital and storage capacity to hold the larger ledger. In other words, this move was antithetical to the ethos of Bitcoin, and as a result led to a variety of hard forks such as Bitcoin Cash and Bitcoin SV, which have since lost the majority of their market share against the original Bitcoin. Even though there were miners who were on board with block size increases, it was the node majority, the crux of the network’s decentralization, who would not opt into the devolved code, meaning that the original Bitcoin network maintained the secure 1MB block size.

If a few prominent figures in the space couldn’t push this protocol change in 2017, it is highly unlikely to ever get steam again after ‘soft forks’ (i.e. updates), like Segwit, have increased transaction volumes without sacrificing decentralization. With all that said, we can safely assume that Bitcoin’s 21 million supply limit is the digital equivalent of being set in stone.

Proof-of-Work

The Proof-of-Work consensus mechanism is what maintains the network’s security by imposing real world costs on the individuals who update the ledger and bring new coins into circulation.

Until the invention of Bitcoin, the Byzantine Generals Problem stumped the world’s best minds; in a hypothetical siege of a city, an army with Generals placed at each city wall can only mount a victorious conquest if all generals act at the same time. With no way of knowing if any of the generals or messengers between them are corrupted (i.e. passing false information), how can the army launch a successful coordinated effort? In other words, how is that consensus can be agreed upon when there is no central authority dictating correct information for participants to act on? The problem, stemming from the field of Game Theory, suggests that participants in a system are continuously basing their decisions off their incentives, and that individual incentives are not always known to the greater group.

In any given system, there will almost always be actors who are incentivized to cheat, or perhaps better stated, in systems without strong enough positive incentive structures, a certain number of actors will gravitate towards fraud and deception. In digital systems, fraud is exceptionally ripe as files and data can easily be copied, with individuals looking to profit from pirating (i.e. counterfeiting) the original information. As this relates to the issuance of a digital form of money, the double spending problem arises – how is that specific data can only be sent (i.e. spent) once, without the s(p)ender holding onto the original data (i.e. money)? Enter Hal Finney’s Proof of Work (PoW) consensus mechanism.

PoW masterfully solved the Byzantine Generals and double spending problems by providing a viable method that enables decentralized consensus. This process means that miners who wish to bring new bitcoins into circulation while verifying the networks transactions must spend money and resources on electricity in order to solve highly complex, costly mathematical problems (i.e. the SHA-256 hashing function) with a solution that is easy to verify once the answer has been found. PoW creates an incentive structure where attempts at cheating are highly costly. If a fraudulent transaction was pushed by a miner, it would require them to spend a significant amount of money to solve the PoW hashing function and broadcast the transaction, only for it then to be rejected by the nodes who can freely, easily, and quickly mathematically verify its illegitimacy. PoW is what provides, tethers and anchors the intangible value of Bitcoin to physical reality.

Hash rates as a measure of security

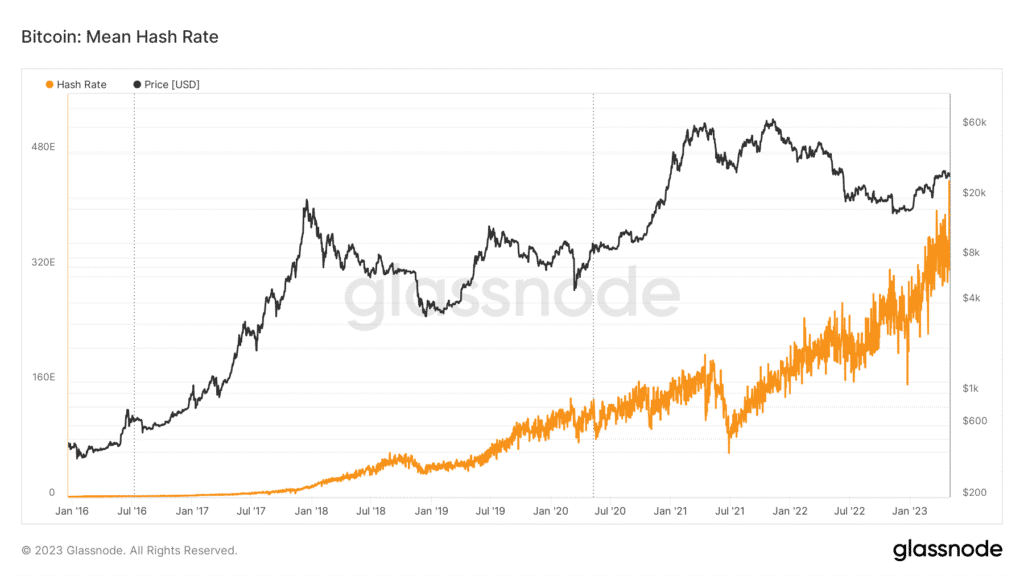

The total amount of computational power that is used to secure the Bitcoin network at any given time, through PoW mining, is known as the hash rate. A higher hash rate translates to increased security as it means there are more nodes and miners verifying transactions, decreasing the chance of a 51% attack.

Like Bitcoin’s price, its hash rate continues to soar to new heights. (Source: Glassnode)

A 51% attack would be a coordinated effort that took over half of the network’s miners and nodes, before processing and accepting fraudulent transactions to erode all faith in the mechanics of the protocol. This scenario has no true winners, only a rogue group of actors hellbent on destruction. While this may have been feasible for a large nation state or corporation to do earlier in Bitcoin’s life, the amount of raw processing power behind Bitcoin has now usurped all of the world’s biggest supercomputers by orders of magnitude. (Where the Bitcoin network’s hashrate is now measured in exahashes per second (EH/s), or in other words, quintillions of hashes per second, the world’s largest supercomputers are measured in petaflops, or quadrillions of hashes per second.)

Bitcoin’s secret sauce – The difficulty adjustment

Along with all the “ingredients” mentioned so far, there is an additional one we can liken to the “secret sauce” which is known as the difficulty adjustment. Bitcoin’s difficulty adjustment is a mechanism built into the protocol that ensures the stability and security of the network by regulating the rate at which new blocks are added (i.e. this is how the blocks are maintained to a 10 minute span between mints). The difficulty automatically re-adjusts every 2016 blocks (roughly 2 weeks) in response to the hash rate. If the hash rate is higher, and blocks are being minted in a span shorter than 10 minutes, the difficulty gets harder. If the hash rate is lower and new blocks are taking longer than 10 minutes to be added, the difficulty decreases. This periodic recalculation to ~10 minutes dramatically increases the security of the network as it allows the hash rate to continuously increase without the inflation rate (issuance schedule) increasing. Additionally, it makes Bitcoin the most reliable payments network in the world with a new final settlement approximately every 10 minutes; compared to the 30 to 90 days it takes for banks to reach final settlement, the unparalleled efficiency is abundantly clear.

An aside: Throughout this section the word “blocks” has been used to describe the groups of transactions which are verified every 10 minutes on the Bitcoin protocol. In the Bitcoin Whitepaper, Satoshi described the PoW process as “blocks [that] are chained”. It was not until at least 2015 that the buzzword “blockchain” entered the public lexicon on account of the increased investment and marketing for technologies that rode Bitcoin’s coattails. Blockchain is not a core ingredient of Bitcoin, but rather describes the PoW consensus mechanism and has since been co-opted by the corrupt economic system which seeks to take value without creating any.

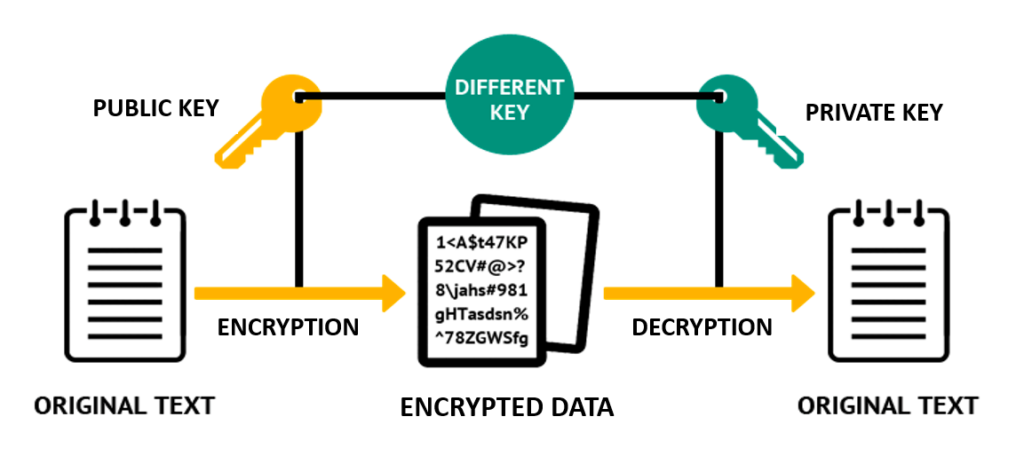

Public-key cryptography

The reason you’ll hear Bitcoin referred to as a “crypto-currency” is due to the public-key cryptography which the protocol relies on. In essence, this means there are pairs of keys, one private and one public, the former of which corresponds to the latter mathematically, while being computationally impossible to deduce back from public to private key. More simply put, private keys are to public keys, what passwords are to email addresses; anyone can know your email address and send things to it, however it is only the password that can unlock the email to read its messages and send new ones. This is where the famous Bitcoin mantra – “Not your keys, not your coins” comes from. If an entity finds out one’s private key, or if one entrusts an institution to manage their keys, this necessarily means that an outside entity has control over one’s funds, and can send them to another address without one’s consent; an irreversible transaction. This is why it is necessary to take full control over one’s bitcoins by generating one’s own private keys, instead of relying on an intermediary to generate and store keys on one’s behalf.

Public-key cryptography is a ‘one way street’. (Source: Simplilearn)

Functionally speaking, a binary string of 1’s and 0’s code for all computer programs, Bitcoin included. In order to generate one’s private-public-key pair, a certain number of 1’s and 0’s need to be randomly recorded by flipping a coin or rolling dice. By generating this entropy, or randomness, one creates a mathematical probability that is so essentially close to zero that it would never be repeated. This one-of-a-kind set of 1’s and 0’s is then converted from a set list of 2048 words into a mnemonic string, known as a seed phrase. This seed phrase, upon the user’s choice, can be between 12 and 24 words – however the level of randomness generated from 12 words is so sufficiently high, it is virtually redundant to use more. A 12-word seed phrase provides 128 bits of entropy, equating to 2128 possible seeds; to have someone guess a single one would be the same as asking someone to find the right, one grain of sand on a quintillion different earths. The sheer magnitude of possibilities is mind-bogglingly astronomical.

Where the binary string creates the mnemonic seed phrase, the mnemonic seed phrase then creates the alphanumeric private key. As the seed phrase directly codes for the alphanumeric private key, it is only ever necessary to remember the words; however, it is this alphanumeric private key which then creates the public key address(es). To reiterate, it is mathematically infeasible for the private key to ever be deduced from the public keys. For additional context, if a supercomputer was able to guess one trillion seed phrases per second, it would take longer than the current age of the universe to arrive at a given seed. While these numbers can be hard to comprehend because they are so large, it is safe to say that Bitcoin is the most cryptographically secure network in the world.

Bitcoin’s staying power

It is only when all the ingredients mentioned above are fully considered and understood in relation to each other that one can appreciate the perfection that Bitcoin represents. This essence was captured by an early cryptographic pioneer:

There’s something unusual about Bitcoin.

So, in 2013 I spent about 4 months of my spare time trying to find any way to appreciably improve Bitcoin, you know across scalability, decentralization, privacy, fungibility, making it easier for people to mine on small devices, a bunch of metrics that I considered to be metrics of improvement. And so I looked at lots of different changing parameters, changing design, changing network, changing cryptography, and you know I came up with lots of different ideas, some of which have been proposed by other people since.

But, basically to my surprise, it seemed that almost anything you did that arguably improved it in one way, made it worse in multiple other ways. It made it more complicated, used more bandwidth, made some other aspect of the system objectively worse.

And so I came to think about it that Bitcoin kind of exists in a narrow pocket of design space. You know, the design space of all possible designs is an enormous search space, right, and counterintuitively it seems you can’t significantly improve it.

And bear in mind I come from a background where I have a PhD in distributed systems, and spent most of my career working on large scale internet systems for startups and big companies, security protocols, and that sort of thing, so I feel like I have a reasonable chance if anybody does of incrementally improving something of this nature. And basically I gave it a shot and concluded, “Wow there is literally, basically nothing. Literally everything you do makes it worse.” Which was not what I was expecting.

As is often said in the Bitcoin community: the protocol changes people far more than people ever change the protocol; almost as if Bitcoin is the training-wheel framework built to catapult humanity into a new mode of perception and cooperation.

Bitcoin is the shining beacon of hope

The power and promise of the internet is that it allows ideas to be shared at the speed of light, with tremendous impacts on the rate at which people are able to learn, organize and grow. The internet, at its foundational layers, is decentralized as these protocols can be used by anyone and are owned by no one. As early users of the web can testify, the fully decentralized web posed a discovery problem; how is that one would find what they are looking for in a sea of data?

The natural solution which arose in response to the discovery problem was to have centralized gatekeepers who would store the mass amounts of data on their servers, and index the information so it was easy to find. Think about how Google makes it simple to find keywords or webpages, and how Facebook and LinkedIn allow you to find people; the inherent tradeoff between decentralization and scalability (i.e. usability) once again rearing its head.

As we have seen, over-centralization leads to abuses of power: evidenced in social media cases of Facebook using their algorithm to influence democratic elections (to the point where the word ‘democratic’ suddenly becomes unfit), or the FBI working with Twitter to silence information that exposed government lies such as election fraud and mRNA vaccine dangers.

Much like the fate of the legacy media outlets, social media companies have been captured by the incentive structure of the fiat system which places paramount importance on advertising and consumption, instead of building, investing and saving.

As we have additionally seen, open source protocols grow in layers. While it was necessary in the early 2000’s to have centralized gatekeepers who distributed our digital money and media, now with the invention of Bitcoin and NOSTR, humanity has sharpened their tools and possesses the open source, trustless protocols that can serve as a new foundation for uncensorable money and communication.

Bitcoin is the hardest money ever created

I don’t believe we shall ever have a good money again before we take the thing out of the hands of government, that is, we can’t take it violently out of the hands of government, all we can do is by some sly roundabout way introduce something that they can’t stop.

– Friedrich Hayek

It seems eerily synchronistic that Bitcoin was launched in 2009, in the wake of the largest financial crisis in recent history, and similarly, it also seems unlikely that Bitcoin could have been invented if it weren’t for the numerous cryptographic and computational advancements that preceded it. The idea of technological determinism touches on this notion and begs the question – does society shape technology or does technology shape society?

The answer is both, in a continuous interplay between dynamically interchanging opposites; centralization versus decentralization, scarcity versus abundance. The rise of Bitcoin is now swinging the pendulum back towards individually-owned, scarce money that appreciates, and away from centrally controlled money that leaves the average savings account scarce.

Similar to the invention of the printing press, Bitcoin exists because there is a need to take sovereignty over one’s actions, which starts by controlling one’s access to information and means to transact.

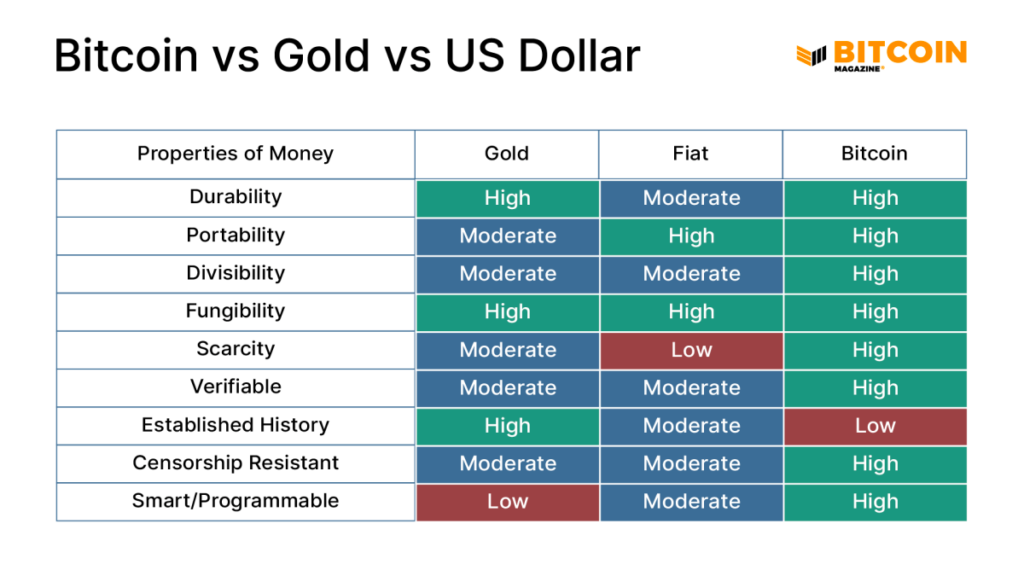

Properties of money of Bitcoin have improved upon their Gold and Fiat predecessors. (Source: Bitcoin Magazine)

To solve the problem of broken money, the technology for the hardest asset to produce was brought to life. As we have seen, Bitcoin is the soundest form of money created in recorded history as it is the first truly scarce asset. Given that Bitcoin has a fixed supply, it is harder to produce than gold (the next hardest asset), which sees consistent 2% increases to its supply per year.12

Further, Bitcoin is the soundest form of money we have as it serves the most accurate unit of account and most efficient medium of exchange. The former as each Bitcoin is divisible into 100 million discrete units, known as ‘satoshis’ (a.k.a ‘sats’), as well as the fact that its supply cannot be manipulated. The latter as transactions can be sent from virtually any internet-connected device, and final settlement takes 10 minutes, with optionality for instant transactions taking place on the Lightning Network. Its durability is a function of its immutable and uncensorable nature on account of its decentralization.

Finally, Bitcoin has so far proven to be humanity’s best store of value offering a vehicle with positive returns for all who hold for more than 4 years.

Stack sats, stay humble.

– Bitcoin proverb

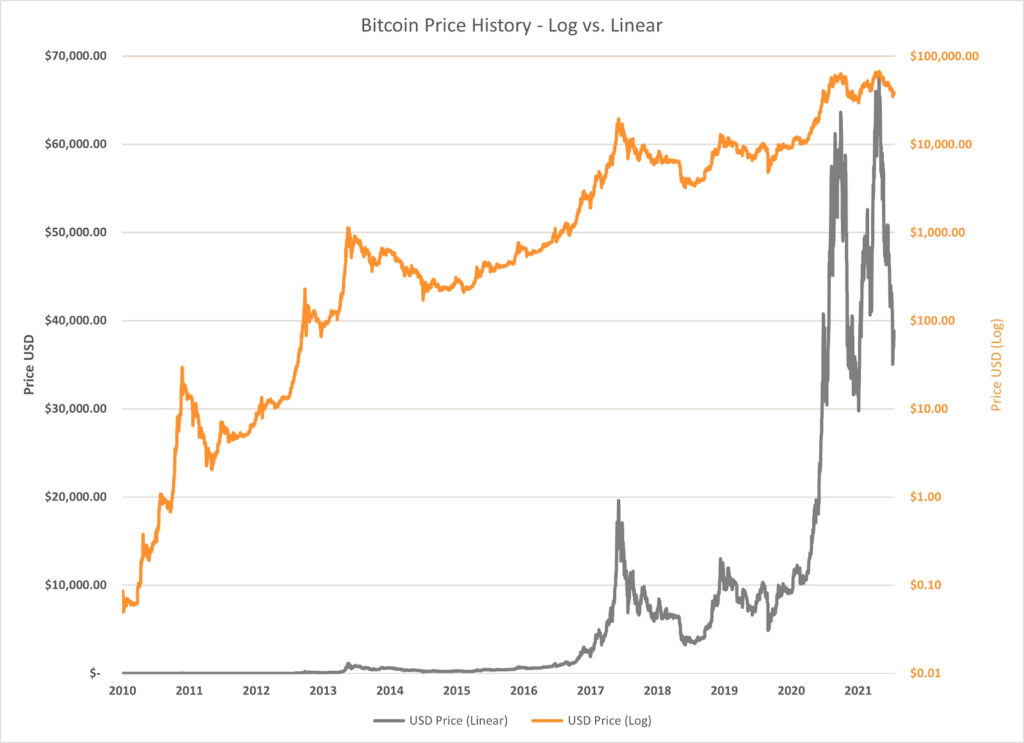

Choose your volatility wisely. While Bitcoin may seem to be too volatile an investment and store of value, in light of everything we now know, would we rather have exponential volatility on the upside due to a finite supply causing price appreciation, or volatility on the downside (with US dollars) as they continuously lose around 7% of the purchasing power per year? The choice is now up to each individual, business, family unit and community. Make yours wisely as the future of humanity quite literally depends on it.

Logarithmic scales are used to analyze exponential growth – when looking at the log graph, Bitcoin’s growth has been consistently steady. (Source: Monochrome)

Acknowledgments

First and foremost, thank you Satoshi for creating a technology which is truly for the people.

Additionally, I’d like to extend my gratitude to those who fostered my curiosity to learn – my dear family and friends.

Finally, to the incredibly intelligent people whose work brought me up to speed on everything History, Money and Bitcoin….

Saifedean Ammous

Michael Saylor

Robert Breedlove

Preston Pysh

Lyn Alden

Jeff Booth

Jack Dorsey

Arman the Parman

Der Gigi

Ray Dalio

Tony Seba

2 Responses

Very well written and comprehensive Jack. A fantastic resource.

Very interesting and eye opening.